This comes up frequently, so I wanted to address it properly.

When I first started in recruitment, the very first retained role I recruited for was the Head of ALM for Barclays Bank, rapidly followed by the Head of ALM at NatWest.

These were senior, highly technical positions inside group risk. Managing the bank’s actual liquidity and capital – the stuff that keeps the institution strong – not client money or customer deposits.

So, I went headfirst into ALM, Monte Carlo simulations, VaR…

I met with some amazing Heads of Group Risk & ALM, learned some of the intricacies, and I genuinely loved that world.

But over time, something became very clear to me…

In banking treasury, you tend to become highly specialised…

Cash management. ALM. Liquidity. Funding, etc. It’s one lane taken very far.

The expertise is an inch-wide but a mile-deep.

Corporate treasury isn’t built like that.

In a corporate role, cash management is just one part of the job.

So is FX…

So are systems…

So is debt, risk, stakeholder management, team leadership and strategic planning.

It’s broader by design.

You’re expected to join the dots across multiple disciplines, not sit inside one.

That difference matters. Especially for candidates.

I often speak to people in banking who want to move into corporate treasury.

Now, some DO make the transition. But it’s rarely simple.

To step out of a specialist position and into a much broader corporate role, many have to move down in title, scope and sometimes salary (often significantly) to rebuild from a different base.

Keith Gaub – Vice President and Assistant Treasurer at Bristol-Myers Squibb – did that exact thing. He talked to me about his sacrifices (and eventual payoffs) of stepping down in title and compensation on a podcast last year, which you can listen to here.

And that’s why I’ve made a very deliberate choice:

- We don’t recruit sales roles in banks

- We don’t recruit group risk / ALM roles

- We don’t recruit across dozens of banking functions.

We recruit corporate treasury. That’s it.

Trying to remain active in banking treasury recruitment never made sense for a specialist firm like ours. It’s better for our clients, candidates, and ourselves if we stick to our lane.

Because depth matters.

I love being a Corporate Treasury Recruitment specialist and I want to be a genuinely valuable treasury recruiter.

That’s also why I love corporate treasury…

I love talking to corporate treasurers about liquidity, debt, FX, risk, systems, careers, teams and progression.

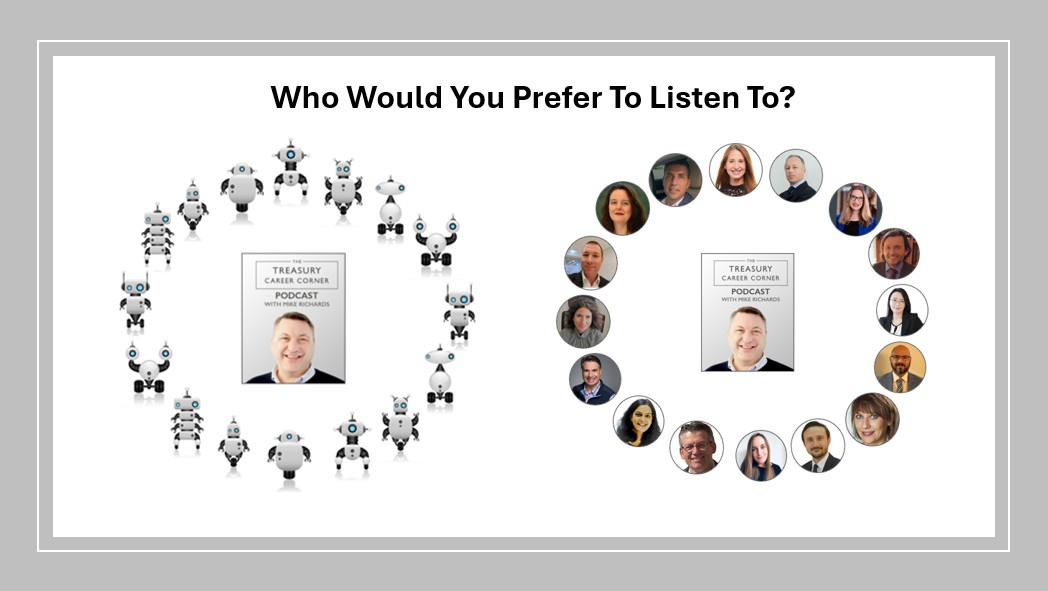

I love hearing their stories on the podcast – over 400 episodes, hundreds of professionals, and 7+ years of conversations.

And I love helping businesses and treasury professionals find the right long-term fit.

So, if you’re in banking and considering a move, I’m happy to share the details of banking treasury recruiters who can help you depending upon where you are in the world.

But when it comes to recruitment, we are…

Corporate Treasury Recruitment Specialists.

Best regards,

Mike

P.S. Without the risk of sounding too confident… We’ve been successfully recruiting for corporate treasury roles for over 25 years, so if you’re looking for a new role in Corporate Treasury please reach out and connect!