Results: 100%合格率のTDA-C01日本語 試験問題集試験-試験の準備方法-一番優秀なTDA-C01日本語 テスト参考書 🕴 ⇛ www.goshiken.com ⇚に移動し、✔ TDA-C01日本語 ️✔️を検索して無料でダウンロードしてくださいTDA-C01日本語復習過去問

Treasury Career Corner LIVE, NY, Thu 12th Sep 2024 🏢

Treasury Career Corner Live in Athens, Greece, 13th June 2024

Steps to Treasury Success with Gary McGuire

Privacy Policy

Treasury Career Corner Live in New York 6th March 2024

Treasury Career Corner LIVE, London, Thu 21st Nov 2024 🇬🇧

How Much Does It Cost to Recruit through The Treasury Recruitment Company?

So, you want to understand our fees and how we structure them?

No problem read on…

How Much Does It Cost to Recruit through The Treasury Recruitment Company?

Well, it depends…let me explain. We do a great job at recruiting Treasury professionals. We work in a niche industry that means lower volumes of activity, so we don’t benefit from the repeat assignments and volume of positions that many generalist recruiters have access to. That makes it harder to work at lower fee levels we must target candidates and clients and costing us time, effort and money when researching to find talented treasury professionals. That must be paid for us to give a great service and this is what we want to do!

We are often asked to agree to 18%, 15% maybe 12% fees….

“Mike our other guys on our PSL have agreed to work at cheap rates. You are at 30% for the senior roles and 25% for the junior roles”

Yes, I am, as that is what it costs us to recruit people for you! Why don’t you give the role to the guys on your PSL at 15% and see how they get on? There’s a reason they are cheap…they will look for the next couple of months or so and they may get lucky and find one or two candidates. Good luck to them, they will need it. After 6 to 8 weeks they have not produced a successful result! I get the call:

“Mike I want you to do a search for us”

“OOOOKAYYYY” I say with trepidation knowing what’s coming next….

“Mike, we would love to give you a crack at the search!”

“Greatttttt”

“BUT we want you to match the fees of those guys who have produced no results for the past 8 weeks….”

RIGHT….

“Yep, we still want you to work on a contingent basis where all the risk lies with you”

RIGHT….

“Mike, I want you to invest your time and money in doing the search with no guarantee of revenue in the process but don’t worry zero cost and zero commitment from us”

Yep 100% risk to you and 0% to us to use your services.

Oh, and by the way you should know you will be going into a “scorched earth” Treasury Recruitment market where a series of generalist recruiters have blanketed the market, mis-sold the role, some of them can barely spell the word treasury let alone recruit for it. If there was someone nearly suitable they have probably decided that as you are using a terrible agency to recruit you’re not serious about treasury anyway and they have been turned off to the role by the recruiter.

Mike, good luck with the role because you are going to need it!

Okay, this sounds like one of my RANTS. Well, it’s not as we can offer at least THREE, YES, THREE SOLUTIONS!

Our fees depend upon what method you want to use with us – it may be one of the following;

SOLUTION 1 – CONTINGENT SEARCH

“No-Win, No-Fee” / “No Cure, No Fee” – Full Fee If I Am Successful!

A Client will pay us say “25% or 30%” fee for a full search if we are instructed on it but it is a “NO-WIN, NO FEE contingent basis”.

If we find them the right treasury person, then we want a full fee. If we don’t find them you don’t pay us. We will do the work, but we take 100% of the risk for a full fee!

If we recruit a Treasurer at £200,000 or $300,000 they should be worth their fee if they can’t save their fee by:

- bank refinancing or savings through a new Treasury management system

- motivating the team and getting much more out of them in the first maybe three, six or at least within the first twelve months

Then probably you won’t want to recruit that person anyway!

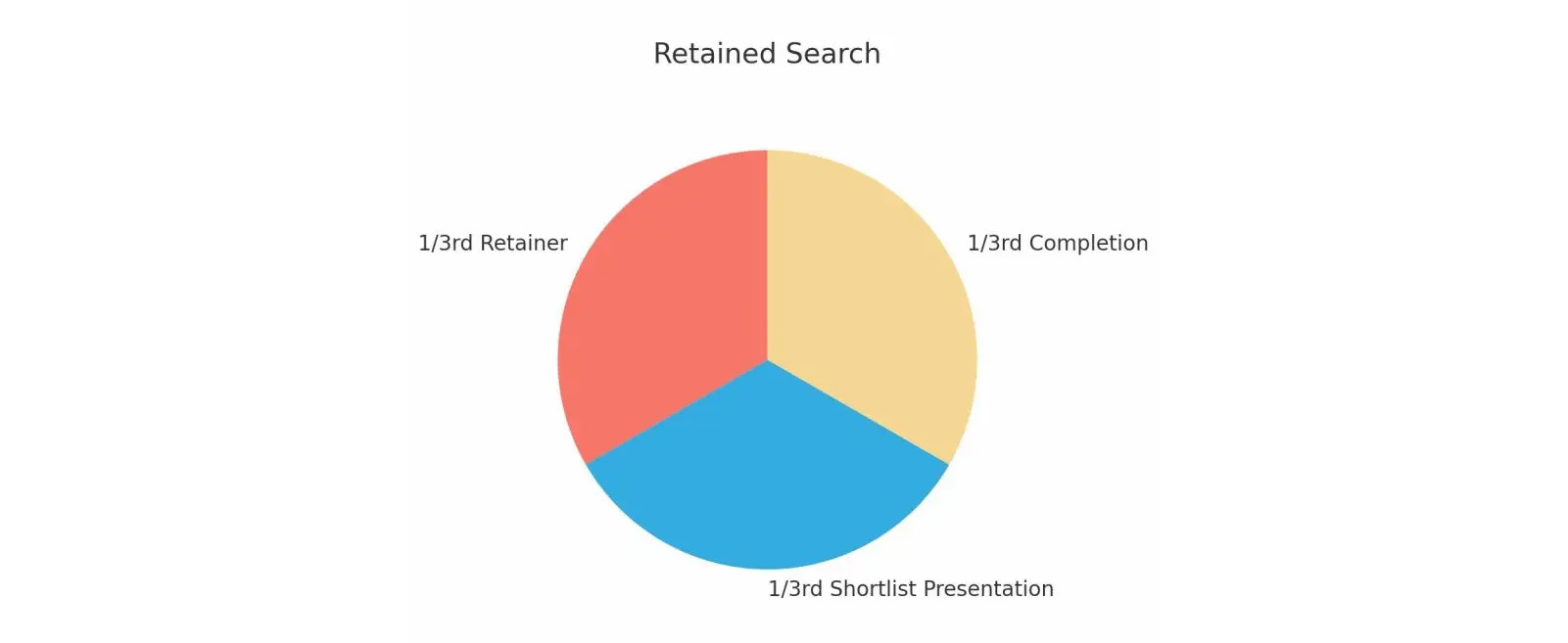

SOLUTION 2 – RETAINED SEARCH

Retainer, Shortlist Fee, Completion

Client;

“Mike, let’s de-risk this process for both sides and I will retain you to find me a Treasury person, but I would appreciate some flexibility on the fee as I am committing exclusively to you.

What can we do? Can we work together on this?”

I am often able to show flexibility on the fee as you are trusting in me by retaining me and I will be able to dedicate time and paid research resource to the search as simply speaking you are paying for MY TIME.

I believe I can recruit the role and I want to work on it with you.

Usually, I will charge you one third of what the estimated fee will be at the beginning. You will be paying for my time.

Will I make loads of profit from the Retainer fee? No.

In most cases, we will not break even / make a profit until a Shortlist fee is paid. The profit for us as a recruitment business is in the COMPLETION fee.

We agree that I will charge you your Shortlist fee when I give you a shortlist that you love. When the person starts I charge you the COMPLETION FEE.

If my shortlist fails I don’t charge you, I find you a more suitable treasury professional.

If the person doesn’t start I don’t charge you I go back to a shortlist stage and find you more great candidates.

So, RETAINED SEARCH – Mike what’s your record?

I have a 100% RECORD OF RETAINED SEARCHES over the past 20 years.

That’s some record!

Yep, 100%…

Sorry, what does that mean to me as a client?

That means I know you will work and work and work to find you the right person?

Have I lost money working on retained searches in the past?

Yes – I have!

Why?

Because I have never failed over the past 20 years and I don’t intend to start NOW!

I will charge;

- 1/3rd at the beginning as a Retainer

- 1/3rd upon presentation of Shortlist

- 1/3rd upon Completion i.e. when the person starts with you

Maybe you have been burnt by recruiters who charged but they did not deliver results!

How about we combine both approaches and meet in the middle?

SOLUTION THREE – STAGED SEARCH

Retainer, Completion Fee

As before I charge you a retainer, this will pay for some of my time.

- 1/3rd at the beginning as a Retainer

- 2/3rd’s upon Completion i.e. when the person starts with you

The overall fee will be lower than the CONTINGENT APPROACH where I took all the risk, but it will be higher than my RETAINED SEARCH fee as the risk is higher.

We meet in the middle.

I only charge you the final 2/3rd’s of the fee upon completion of the assignment – remember as I haven’t recruited the role I am going to lose money.

I am betting on the fact that I can find you that right person.

You will have paid for some of my time and not been burnt in the process.

I have tried to create what I believe is a “win-win situation” for you as a client and me as a recruiter.

Believe me, I am incentivized to recruit the role – I’m not in business to lose money.

I hope this explanation gave you a deeper insight into what we do for our clients.

If you are a candidate you gained an insight into the world we live in and recruit within.

Maybe next time you are recruiting we can have a sensible open chat about what approach suits you best? I want to recruit your next Treasury professional. That is why I am here. If you are a potential client or candidate – please call me, we would love to help!

Salaries & Recruitment Insights into the US Treasury Recruitment Market

I have been thrilled with the growth of our participant numbers in the US. A 50% improvement between 2023 and 2024. Once again, this gives us a greater insight I to the different salary levels, and it helps us offer more concrete advice to our clients.

When we say to them, we know the average salary of a Treasury Analyst / Dealer is from 35 in our sample. Whereas when we have 57 in our sample, it means the advice we give is more powerful because we have a greater sample size. And that continues across all levels.

At our Global Treasurer / Treasury Director level, our sample size has risen from 35 to 61. And once again, with a total compensation package of $390,000. And its barely shifted, but the fact is, we know that is the typical average salary for a Corporate Treasurer in the US.

There has been strong growth across the whole spectrum of treasury roles from entry level Analysts through Managerial levels up to Senior Directors showing robust demand for treasury. But in the US market, the competition for us in terms of recruitment is still the lack of knowledge of the specialist service we provide.

The Default Setting for HR Teams Is LinkedIn

The default setting for many HR and talent teams in the US for recruiting treasury staff is LinkedIn.

We have often seen clients sift on LinkedIn for 3 to 6 months, unsuccessfully, come to us having had a 100 to 200 responses often. And yet we have been able to fill the position by knowing the best 12 people in the market, putting them forward.

And then next thing we know, we make a placement.

The US’s diverse economic landscape is mirrored in the compensation growth across a range of different treasury positions. But geography is not the only factor. It is a key factor. But at the end of the day, the number of roles, once again, we have seen some roles average out, if you like, in our survey. Not showing a huge increase in salary, for instance, at the Deputy Treasurer level, because several Deputy Treasurers have remained on similar salaries.

However, what I have been seeing is that a few Deputy Treasurers have been promoted, and they have taken on the next level of role going from Deputy Treasurer to Group or Global Treasurer. You have also seen other Assistant Treasurers moving from the Assistant Treasurer roles.

They are paying at the sort of $190,000 range up to around $200,000 to 220,000 range. But I have seen quite static salary levels right across from the upper managerial levels, i.e. Assistant Treasurer and right the way through to Global Treasurer.

So, salary levels have not increased hugely. What I have seen, as I have said in the overall summary, is that roles

themselves have changed drastically from a 100% in the office to number of Treasurer positions, 100% remote.

Do I think this will last? No.

I think Treasurer roles will become 2 to 3 days a week in the office to help guide, manage and most importantly mentor their teams.

Do I think that is the right balance? I do.

I think if someone is demanding that people are back in the office 5 days a week, it is a disadvantage to any employer to have that as it is a negative statement to say to potential applicants, you must be in the office 5 days a week.

You might have a long list of say 100 people before if you insist on 100% in-office this list drops to 10 to 15 if you are lucky! It is not a practical way to think about it.

One needs to review and think, how am I going to recruit this role? Again, that is where we can give realistic advice.

Base salaries for all levels of roles within the US have increased across the board. However, packages themselves have consistently remained consistent, i.e. value-added packages have not really increased. What I have seen is several clients have been saying, I am not going to make a move this year simply because this will be the first time, I am collecting a decent bonus or a bonus in many cases post COVID.

They got zero bonus during COVID or an exceptionally low bonus. They were being told they are lucky to have a role. Then the year after COVID it started to get back to normal. The year on from that, which is this year, they are now starting to go, okay.

Now I would like to get some more bonus, please, or I would like a decent increase in my package. Well, no. You are not going to get it. Okay.

We are getting an absolute influx of resumes from senior treasury professionals desperate for their next move. So once again, if you are looking for people, looking for senior candidates, just give us a call. We would love to help.

We are aware that competitors create surveys simply to have something to talk about on LinkedIn unlike competitors’ surveys, our 100% real data approach ensures unique and reliable results.

Our Treasury Salary Surveys are 100% Real!

With your support our authentic survey, offers unique value – “we use real data from treasury professionals, to give a one-of-a-kind treasury salary survey for treasury professionals globally.”

Please share our survey within your treasury network – colleagues, team members, superiors. The few minutes they give to the survey make it the powerhouse it is to this day!

Any suggestions on its content or areas to be explored are welcome. With your help, every day we improve the survey, thanks for your support.

Thank you to all those who take part in our Salary Surveys. It is only with your input that we can offer the insights into the state of the Global Treasury Recruitment market.

Please Take Part In Our Ongoing Treasury Salary Survey!

This comprehensive survey is the foremost benchmarking tool for Treasury sector salaries. It gathers data from Treasury professionals worldwide, ranging from Treasury Analysts to Group Treasurers. By participating, you’ll gain exclusive access to the full results at no cost.

We are gearing up for the 1st set of results for 2024, we invite you to join them. Upon confirming your status as a Treasury Professional, you’ll receive a complimentary copy of the latest set of results and you are then included from then on!

All we ask is that you update your salary information whenever you get a well deserved pay rise 😉

Talking about trends in treasury recruitment

Mike Richards, CEO and founder of the Treasury Recruitment Co, discusses the current state of the recruitment market, the impacts of technology on treasurers’ roles, and why promoting knowledge is so important to career development.

Mike Richards, CEO and founder of the Treasury Recruitment Co, has more than 20 years’ experience in treasury recruitment, matching candidates with employers of all sizes in the UK, the US and Europe.

He spoke to The Global Treasurer about the current state of the recruitment market, the impacts of technology on treasurers’ roles, and why he thinks promoting knowledge and advice is so important to treasurers’ career development.

What are the most notable trends in treasury recruitment that you have picked up on recently?

Three or four years ago, people weren’t getting bonuses. We were just coming out of the financial crisis, money was tight, people had got used to getting bonuses previously, and then suddenly that all stopped. That had an impact on the flow of recruitment and how much people moved around.

Recruitment had slowed – certainly at more senior levels it was markedly slower because, unless you had another role to go to, you weren’t out there actively banging on recruiters’ doors. There was always operational recruitment – in the UK (jobs with a salary of) £20,000- £60,000, or $30,000 to $80,000 in the US. But as you go into more senior levels where people are perhaps becoming more career-focused, I wasn’t seeing so much movement. It has started to pick up again but I think the life cycle of someone looking for a role has probably lengthened. The market’s not tumultuous and there’s not a lot of stuff out there. It is moving, but it’s gradual.

I think there are three sides of a triangle here; treasurers have always been technically strong, so for jobs of up to £100,000, the questions employers ask are ‘have they done cash management, or have they done FX?’ – it’s about ticking boxes. When you get to more senior levels it’s more about handshake; you know the candidate’s going to be technically strong, but do they fit in with the company?

The next side of the triangle is, are they going to be IT-savvy? This doesn’t necessarily mean to say they’re systems guys, but are they going to be able to hire good systems guys or project manage the system, or make sure their treasury really is versed in things like straight-through processing, or SWIFT, or cryptocurrency.

When you talk to senior treasurers or CFOs, they’re looking for a treasurer who can really manage people and inspire the team, but often they haven’t been given the training

The third point, which I think has really been the biggest thing and I’ve been banging the drum about for a couple of years now, is that treasurers and treasury professionals have been asked to be people managers. And often they’re not very ‘people-savvy’. Those who are have often done really well, and those who aren’t have suffered. A lot of the time when you talk to senior treasurers or CFOs, they’re looking for a treasurer who can really manage people and inspire the team, but often they haven’t been given the training.

They’re being put in charge of managing a team of anywhere between three and 25 people, and often there’s very little input on that . The expectation level is there, but what are doing to help them? I think that’s the input they need.

I’m going to be running a course about personal profiling and personal branding, but also interviewing skills – when you’re interviewing someone to come and join you, how effective an interviewer are you? Getting the best out of candidates is not something most people have ever been trained on. And that’s where I think the missing part the triangle is a lot of the time.

As the lines increasingly blur between businesses such as retailers and tech companies, for example, how are the required skillsets in treasury roles changing?

I was talking to the international treasurer at Johnson Controls – a big corporate with a technology core – about team management. I asked him what he would say is the biggest thing that’s changed in the last 15 to 20 years. And he said, ‘My treasury systems guy – he’s really got to be the hub of everything, to manage all these different technologies and be a translator between the IT guys and treasury. Without him I literally don’t know how we would function.’

He said he is the critical linchpin – without him joining up the IT and treasury functions, the two sides would just drift off over the horizon like the train in Westworld.

The key skill is actually translating these things into business needs. You get Amazon that becomes the centre of everything, and everything starts moving really quickly. It’s the companies that get on board with that stuff that are making progress.

Treasurers often aren’t early adopters. They have to de-risk everything because that’s what they’re paid for. They’d like to be at the leading edge, but that’s not their job. Their job is to look after the cash and then make the best utilization of that cash.

Automation in treasury departments is a hot topic at the moment. Have you seen this affecting recruitment, and is it something treasurers are concerned about?

Previously with manual, repetitive, routine tasks, they got outsourced or moved overseas. And then as soon as technology caught up in some of those areas you could move to a system that could do them. Routine tasks will always be gradually systematized, and if you can you will put them into a system that can handle them far better, 24/7 – which is brilliant.

But at the end of the day you’ve still got someone at the other end to turn the handle and input the stuff. It’s not just employing someone to feed in Charles Babbage cards; you need someone who actually knows what they’re doing. But the fact is, if you can replace two people earning £40,000 with one person earning £60,000 who knows what they’re doing, you save £20,000 and also you’ve got a system.

Also, if you were to employ a new person you’d check their references; if you bring in a new system how much reference checking would you do? Do you speak to three other people that are already using it, to find out what the problems are with it before you bring it in and actually switch it on? A lot of the salesmanship around these things can be prone to overstatement.

You recently wrote a post about the role of women in treasury. To what extent do you think gender plays a role in the recruitment process?

Whether you’re a man or a woman, getting into treasury isn’t necessarily an issue. There are some extremely talented women who go into treasury. I was speaking to a FTSE 100 treasurer and she said she’d been lucky to have had bosses who have been supported her in her career growth.

I do see that it can be difficult in terms of having a break in your career due to having children. I’ve seen cases of men who might have had to take time off, due to health issues for example, and often they’ve been treated far better than women who’ve taken time off to have kids. It can be frustrating.

Ultimately, if I’m recruiting someone I will try and recruit the best person for the role. White or black, man or woman, it doesn’t matter as long as they’re the best treasury person for that job.

I recruited all the treasury team for a big retail company, and at one stage it ended up being a team of five women and one man. And people said, ‘You’re just putting women forward for this.’ But no, at that time they happened to be the best candidates for those roles.

What do you think are the benefits of taking a risk when it comes to applying for a new role?

I would say that treasurers are not necessarily risk-averse; they’re risk-aware. They take a very balanced view – they’re like bookies in some ways, in that they’re constantly measuring the odds of success and they are constantly hedging their bets. They’re looking after their company’s money and they’re looking at the risk.

I think that can directly transfer across if they’re looking at a new role. It’s going to depend on their propensity to and attitude towards risk. I just had a client who has moved from a FTSE 100 group treasurer job because they were being taken over, and he’s gone into a consultancy role. He said ‘I can afford to at the moment because I don’t have a direct role to go into, and the market itself isn’t flying.’ He said he could take a risk. He can look at this role in terms of building his career.

I think there are more diverse industries now and that give treasurers more opportunities

Now you’ve got new things coming in such as new payment companies and tech start-ups, and people are saying they could try something different and see what else could that be out there.

It used to be that people would stay in roles for probably five to seven years, whereas it’s much more accepted now to make a move every three years, whether that’s internally or externally.

You might get a FTSE 100 treasurer looking to move to a company further up the FTSE, but there are only 50 of those big jobs, so what do you do next? If there’s a new payments provider, for example, that might float and become bigger, that might become an option. I think there are more diverse industries now and that give treasurers more opportunities.

You’ve hosted a number of ‘Treasury Career Corner’ events. Can you tell us a bit more about that?

The aim is to explain to treasury professionals how other treasury professionals made it and how they got there. What was their career path? What did they do to make themselves different and stand out?

Treasurers can sometime be seen as being a bit boring, but believe me, they’re not. They’re generally the first people at the bar and the last people to leave! They’re very outgoing, forward-looking, proactive people, really gregarious.

Treasury Career Corner is about talking to treasury managers about what their magic moments were in their careers, and passing on that advice. That’s why I love doing the job I do.